Online PAYE Tax Calculator with changes in Finance Act 2020

Chima got her dream job with a juicy compensation. The gross pay looked fine. Based on the contract, she estimated an increase in gross salary of 35% compared to her previous job. However, when she received her payslip at month-end, the actual increase was 20%.

John wants to hire new employees in Nigeria and wants to determine the total payroll cost. The individuals will be a mix of low-income earners, expatriates, and local employees.

Ade is in charge of deducting and remitting the payroll tax of thirteen employees in Newbie Limited. He usually pays PAYE tax to the revenue authority for each month in 2021. However, all calculations were not in line with the Finance Act 2020. Six employees resigned in June 2021. Ade did not charge the correct amount of tax throughout the employment of six staff. One sunny day, the tax authority issued a letter to Newbie Limited demanding the unpaid sum.

The Finance Act 2020 has changed the way a taxable person will calculate PAYE tax in Nigeria. Two major changes in the calculation are:

- Definition of gross emoluments for consolidated relief allowance (CRA).

- Persons with an annual income of NGN360,000 and below are exempt from personal income tax.

It is vital to make informed decisions in treating payroll taxes. At this point, Ade needs to regularize the tax affairs. Chioma wants to know the reason, so she knows how to bargain for the next offer. John wants to start the payroll compliance cycle in Nigeria on the right note.

IMPACT ON EMPLOYEE

Statutory contributions

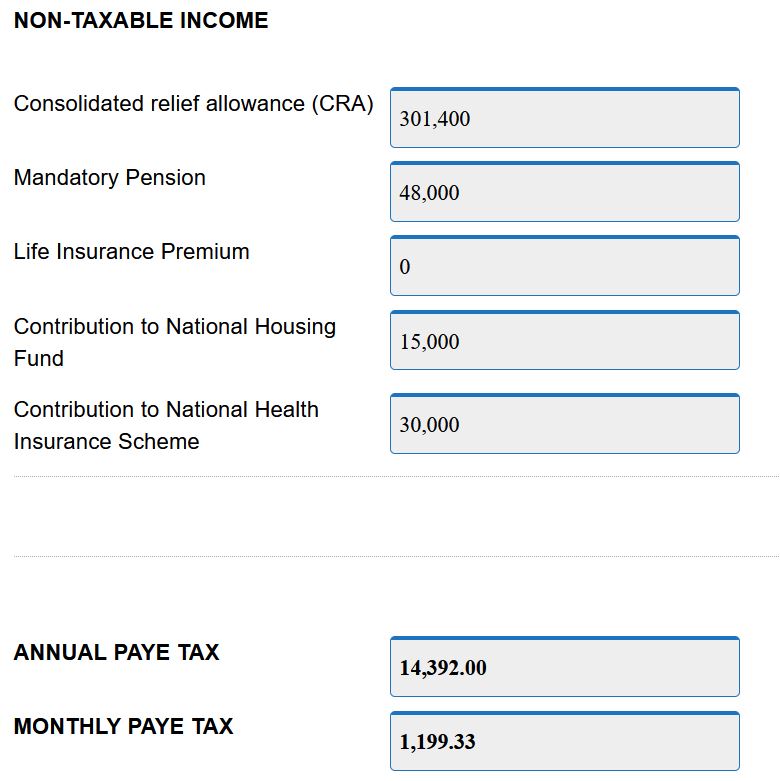

Gross emoluments for calculating CRA exclude statutory contributions and other tax relief granted to an employee.

Higher PAYE tax

Where an employee still makes statutory contributions, the PAYE tax will increase.

WHAT NEXT?

For individuals

- An employee may want to know how much tax applies on monthly or annual salary.

- Other professionals may want to estimate PAYE tax without the stress of setting up a tax report.

- Anyone interested in computing taxes on employment income.

For businesses

- PAYE tax is the tax on employment income. In Nigeria, an employer is responsible for deducting and remitting the tax amount to the revenue authority.

- Complying with different statutory filings as well as the monthly payroll tax compliance cycle can be tedious.

Fee: N3,250 per annum *

With the online calculator, you can calculate the

- PAYE tax,

- pension, and

- statutory contributions of an employee based on the new law.

*Limited time offer

BENEFITS OF BRC ONLINE CALCULATOR

BRC online PAYE tax calculator helps you estimate the PAYE tax and statutory deductions from an employee’s salary. They include contributions to an approved pension fund and national housing fund. As the Finance Act 2020 takes effect from 1 January 2021, it is necessary to use the new PAYE tax rules.

It is an excellent tool for employees, workers, human resources managers, finance managers, individuals, expatriates, employers, payroll administrators, and anyone interested in estimating his/her Nigerian PAYE tax.

PAYMENT DETAILS

| Item | Annual Fee ( |

| Online PAYE tax calculator with changes in Finance Act 2020 | 3,250.00* |

PLACE AN ORDER

Quick Links

Need to outsource the entire payroll process? Click here to send a request

Blog